PHILIPPINES

(Updated 2017)

PREAMBLE

This report provides information on the status and development of nuclear power programmes in the Philippines, including factors related to the effective planning, decision making and implementation of the nuclear power programme that together lead to safe and economical operation of nuclear power plants.

The CNPP summarizes organizational and industrial aspects of nuclear power programmes and provides information about the relevant legislative, regulatory and international framework in the Philippines.

The Philippines maintains a functional nuclear power plant, though the site has never been operational since construction was completed in May 1984. At present, the Philippines is considering embarking on a nuclear power programme under the current administration.

1. COUNTRY ENERGY OVERVIEW

1.1. Energy Information

1.1.1. Energy Policy

Since the path of energy security cannot rely on one option only, the Philippine Energy Plan (PEP) has laid out essential steps to support the policy thrusts of the energy sector. Below are the plans for the 20-year planning horizon.

Exploration/Development of Conventional Fuels

The country’s conventional energy fuels — oil, gas and coal — will continue to remain indispensable in meeting the country’s energy demand even as the country pursues other alternative energy sources.

Oil and Gas

For fossil fuels, such as oil and gas, the target production level at the end of the planning horizon is 78.59 million barrels. Service contracts, which to date total about 34 million barrels, will increase 40% by the planning period. The country has 16 sedimentary basins and the majority of these areas are found in Luzon, particularly in Palawan.

Coal

Indigenous coal production will increase to a high 250% with the entry of more investors through the energy contracting round mechanisms and the conversion of existing coal operating contracts, from the exploration to the development stage.

Currently, the country imports around 75.4% of domestic coal requirements.

Renewable Energy

Renewable energy (RE) development was given a tremendous boost with the passage of the Renewable Energy Act of 2008. Since its signing, a total of 206 contracts have been signed. The target is to double the RE-based installed capacity to power generation at the end of the planning horizon from its 2008 level of 5 300 MW.

In the case of geothermal energy, a comparatively more advanced resource, the targeted installed capacity will increase from 1 972 MW to over 3 000 MW at the end of the planning horizon, to boost the country’s leadership in geothermal energy development worldwide.

Nuclear

Worldwide, there is a revival of interest in nuclear energy as an energy source. Along these lines, the secretaries of the Department of Energy and the Department of Science and Technology jointly created an inter-agency task force to exactly determine the feasibility of considering nuclear energy as a long term option in the country. The task force validated the results of the Bataan Nuclear Power Plant (BNPP) feasibility study in 2009, which is the major deliverable of a ,memorandum of understanding (MOU) between the National Power Corporation (NPC) and Korea Electric Power Corporation (KEPCO). It also undertook the site safety review of the BNPP. A study on the competitiveness of nuclear power against other fuel sources will also be conducted and, in the meantime, the country is capacitating its capabilities through various training programmes.

Promoting Responsible Use of Energy

The government is developing opportunities to make realistic changes in the way the country uses its energy resources. Energy conservation programmes and technologies will help Filipinos become efficient consumers of energy. For the energy efficiency programme, the plan aims to achieve 10% energy savings on the total annual demand of all economic sectors.

Other programmes for implementation are the monitoring of efficient performance of power generation utilities and electricity distribution facilities, promotion of aviation fuel efficiency enhancement, retrofit of commercial and industrial establishments and voluntary agreement programmes on the rationalization of transportation sector operation.

Ensuring Development in the Power and Electrification Sectors

Given the critical periods in the respective major grids of the country, between 2009 and 2030, the plan provides a list of projects that will come on stream on various timelines. This will include committed projects, as essentially already having financial closure, and indicative projects, as being in various stages of development. A 600 MW coal fired plant is a committed project for Luzon and year of availability in 2012, while for Visayas, two committed coal power plants will provide 328 MW of additional capacity. Four other power projects began with an additional capacity of 325 MW. For the Mindanao region, the Sibulan Hydropower Plant (42.5 MW) came on-stream as did the Cabulig Hydropower Project (8 MW) and the Mindanao Geothermal Project (52 MW).

The Philippine Energy Plan 2012–2030, which the Department of Energy (DOE) launched in December 2012, lays down the road map for future demand and capacity addition plans. As per the plan, the current installed capacity in the country of about 16 250 MW is expected to go up to 25 800 MW (an increase of about 60% by 2030). This is still expected to be short of the projected demand of 29 330 MW in the year 2030. In addition, various interconnecting links between the island grids still need to be developed.

Continued Capacity Addition – The three regions in the Philippines — Luzon, Visayas and Mindanao — will require substantial capacity additions in the coming years. Of the expected capacity, only 1 800 MW has been committed out of a needed projection of about 13 000 MW through 2030.

Grid Connectivity and Strengthening – Installed capacity in the country will increase calling for sufficient investment to strengthen the transmission and distribution infrastructure. In addition, the island grids need to be interconnected. At present, Mindanao is currently not connected with the Luzon and Visayas grid. This will entail huge capital expenditure that needs to be sustained by the energy sector. The Energy Regulatory Commission (ERC) plays an important role in allowing for recovery of investment with appropriate regulated returns for this transmission infrastructure.

Using Energy in an Environmentally Responsible Manner (Climate Change Adaption Measures)

The Philippines, like the rest of the world, is facing a moment of decision in terms of using energy in a more environmentally friendly way. Fully aware of the role and responsibility of the energy sector in helping mitigate the impact of climate change, the plan is introducing the pursuit of adaptation strategies, among which are the following: to conduct an impact and vulnerability assessment of energy systems such as power generation, transmission and distribution, fuel production and transport in the immediate term; to integrate structural adaptations into the design of energy infrastructures to include modification of engineering design practices; and to integrate climate change adaptation to energy policies, plans and programmes, including laws and regulations.

Source: Department of Energy (DOE) Portal (www.doe.gov.ph).

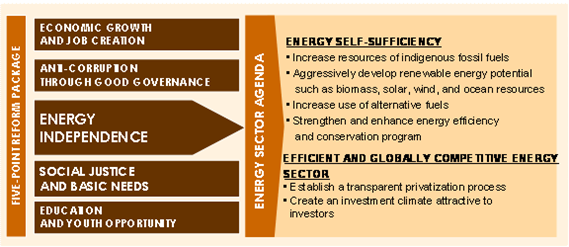

The energy policy reflects the state’s commitments to pursue the energy independence agenda under the government five-point reform programme package, as shown in Figure 1. The first objective is anchored on the effective implementation of the following goals:

Accelerating exploration, development and utilization of indigenous energy resources;

Intensifying renewable energy resource development;

Increasing the use of alternative fuels;

Enhancing energy efficiency and conservation.

Also, the continuing reforms in the power sector, as well as the downstream oil and gas industries, will pave the way in realizing the globally competitive Philippine energy sector.

Fig. 1. The Philippines’ five-point reform package.

1.1.2. Estimated Available Energy

TABLE 1. ESTIMATED AVAILABLE ENERGY SOURCES (2012–2030)

| Estimated available energy source | ||||||

| Fossil Fuels | Nuclear | Renewables (2016) | ||||

| Solid |

Liquid | Gas | Uranium | Hydro | Other Renewables | |

| Total amount in specific units | 250.04* MMT with 10 000 BTU/lb | 106.3* MMB | 2 840.91* BCF | — | 8 111 Gwh | 2 959 Gwh |

| Total amount in exajoules (EJ) | 7.33 | 0.65 | 29.97 | 0.03 | 0.01 | |

—: no data available, MMT – million metric tonnes, BCF – billion cubic feet, MMB – mega barrel.

* Proven reserves as of December 31, 2015.

Source: Philippine Energy Sector Plans and Programs 2013–2030; Department of Energy Energy Planning Study and Pre-Feasibility Study, DOE.

1.1.3 Energy Statistics

TABLE 2. ENERGY STATISTICS

| Compound Annual Growth rate (%) |

||||||

| Energy consumption in exajoules (EJ)** | 2000 | 2005 | 2007 | 2009 | 2014* | 2000–2009 |

| - Total | ||||||

| Solids*** | 0.257 | 0.295 | 0.299 | 0.337 | 2.75 | |

| Liquids | 0.63 | 0.60 | 0.59 | 0.59 | –0.65 | |

| Gases, petajoules (PJ) | 0 | 0.12 | 0.14 | 0.15 | 0 | |

| Nuclear | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. |

| Hydro | 0.028 | 0.030 | 0.031 | 0.035 | 0.033 | 1.07**** |

| Other Renewables | 0.0003 | 0.00074 | 0.00093 | 0.0010 | 0.0013 | 10.32**** |

| Energy Production | 2010 | 2011 | 2012 | 2013 | 2014 | 2010–2014 |

| - Total | ||||||

| Solids*** | 0.0397 | 0.0927 | 0.1095 | 0.1517 | 39.81 | |

| Liquids | 2.57 | 41.36 | 36.28 | 51.27 | 111.34 | |

| Gases, Petajoule (PJ) | 0 | 0.12 | 0.14 | 0.15 | 0 | |

| Nuclear | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. |

| Hydro | 0.028 | 0.030 | 0.031 | 0.035 | 0.033 | 3.34 |

| Other Renewables | 0.0003 | 0.00074 | 0.00093 | 0.0010 | 0.0013 | 34.08 |

*Latest available data

**Energy consumption = primary energy consumption + net import (import–export) of secondary energy.

***Solid fuels include coal, lignite.

**** Calculated for 2000–2014.

Source: Department of Energy, www.doe.gov.ph

1.2. The Electricity System

1.2.1. Electricity Policy and Decision Making Process

The Philippine Distribution Code establishes the basic rules, procedures, requirements and standards that govern the operation, maintenance and development of the electricity distribution systems in the Philippine National Grid Code and the market rules of the Wholesale Electricity Spot Market to ensure the safe, reliable and efficient operation of the total electrical energy supply system in the Philippines.

The Republic Act No. 9136, also known as the “Electric Power Industry Reform Act of 2001”, mandated the creation of the ERC. Section 43(b) of the Act provides that the ERC promulgate and enforce a National Grid Code and a Distribution Code, which shall include, but not be limited to: (a) performance standards for TRANSCO O & M Concessionaire, distribution utilities and suppliers, and (b) financial capability standards for the generating companies, the TRANSCO, distribution utilities and suppliers. The act also mandates the ERC to enforce compliance with the grid code, the distribution code, and the market rules and to impose fines and penalties for any violation of their provisions.

The restructuring of the electrical power industry will result in significant changes in distribution system operation and management. The act allows end-users belonging to the contestable market to obtain power from suppliers who are licensed by the ERC. Distributors must provide wheeling services to these end-users. Distributors must also procure energy from the Wholesale Electricity Spot Market and through bilateral contracts to serve the remainder of the customers in their franchise area.

The Distribution Code defines the technical aspects of the working relationship between the distributors and all users of the distribution system. Distributors must deliver electricity to the users at acceptable levels of power quality and customer service performance.

Source: Energy Regulatory Commission (Philippines).

1.2.2. Structure of Electric Power Sector

The Philippine power industry is divided into three major sectors: generation, transmission and distribution. Under the present power industry structure, NPC generates its own electricity and buys electricity from independent power producers (IPPs). Generation used to be a monopoly of the NPC until the issuance of Executive Order No. 215, which opened the generation sector to private investors.

At present, a number of IPPs generate and sell electricity to NPC and other customers. NPC transmits electricity to distributors and large industrial customers via high voltage wires. NPC is also responsible for constructing the transmission grid highway interconnecting the main islands nationwide.

Distribution of electricity at its usable voltage to end-consumer is performed by investor-owned utilities and numerous electric cooperatives, which sell to households as well as commercial and industrial enterprises located within their franchise areas at retail rates regulated by the Energy Regulatory Board (ERB). The DOE sets policy directions for the energy industry, while the National Electrification Administration (NEA) provides financial and technical assistance to electric cooperatives.

The major reforms are embodied in RA 9136; restructuring of the electricity supply industry calls for the separation of the different components of the power sector, namely generation, transmission, distribution and supply.

On the other hand, the privatization of the NPC involves the sale of the state-owned power firm’s generation and transmission assets (e.g. power plants and transmission facilities) to private investors. These two reforms are aimed at encouraging greater competition and at attracting more private sector investments in the power industry. A more competitive power industry will in turn result in lower power rates and a more efficient delivery of electricity supply to end-users.

Source: www.psalm.gov.ph

1.2.3. Main Indicators

Installed Capacity

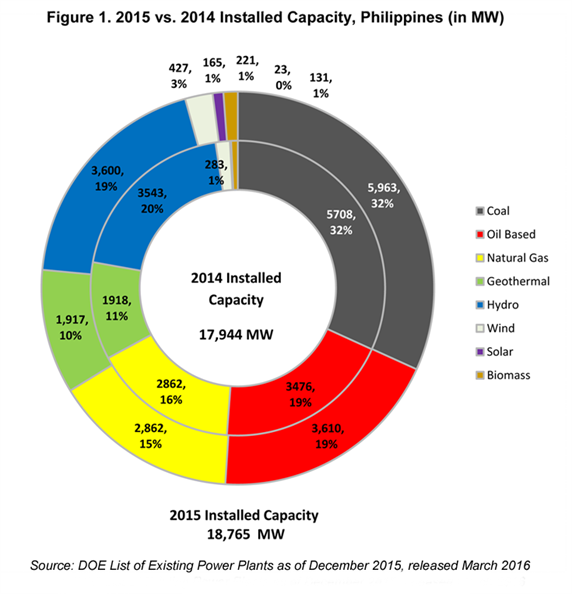

Peak demand growth rate in the Visayas grid recorded a high rate of 8.1% compared to 2.4% and 3.3% growth for Luzon and Mindanao from 2014 to 2015.

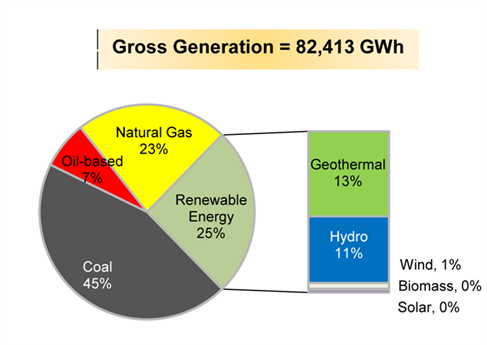

Coal maintained its largest share of the total installed capacity at 32%, dependable and available capacity at 34% and power generation mix at 45%.

Due to the feed-in tariff (FIT), wind and solar grew in terms of total installed capacity by50.9% (144 MW increase) and 616% (142 MW increase), respectively, from 2014 to 2015.

Electricity rates and consumption increased remarkably by 6.7% from 77 261 GWh in 2014 to 82 413 GWh in 2015.

A total of 633 circuit-km of overhead transmission lines were completed and a total of 1 025 MVA additional capacity and 600 MVAr of reactive power support were installed from January to December 2015. The majority of these completed transmission projects are in the Luzon grid.

The Philippines’ total installed generating capacity continued to grow by 4.6% from 17 944 MW in 2014 to 18 765 MW in 2015, equivalent to a 821 MW increase. Coal-fired power plants constituted the largest share of the installed and dependable capacity in 2015 at 32% and 34%, respectively. Among renewable energy sources, the share of hydro sources remained the highest, with a 19% majority, which comes from the Mindanao grid. With the FIT incentives and continued support of the DOE and energy agencies and stakeholders, variable renewable energy (VRE), such as wind and solar, grew remarkably by 50.9% (144 MW increase) and 616.0% (142 MW increase), respectively, from 2014 to 2015 as shown below (Fig. 3).

The percent share on a per grid basis has remained unchanged over the years. In 2015, almost 75% of the total capacity was in Luzon, while Visayas and Mindanao, with at par shares, comprised the remaining 25%. The commercial operation of power plants from different technologies provided the needed additional capacity for the Luzon grid in 2015.

On average, the actual available capacity during peak hours in Luzon, Visayas and Mindanao was 70% of the total installed capacity in the Philippines in 2015. Among other plant technologies, natural gas in Luzon provided the highest percentage of available capacity over installed capacity at 95%, followed by coal at 85% and geothermal at 70%, whereas, wind and solar, due to variability and intermittency, provided the lowest available capacity in 2015 at only 22% and 33% of the total installed capacity.

For Visayas and Mindanao, coal-fired power plants delivered the highest available capacity at 91% and 89%, respectively. The actual available capacity over installed capacity provided by wind and solar was the highest in Visayas at 89% and 72%. However, due to El Nińo, the available capacity of hydro in Mindanao was limited to only 58% of the total hydro capacity.

Fig. 3. Installed capacity in the Philippines, 2015 vs. 2014.

Source: 2015 Philippine Power Situation, Department of Energy (DOE).

The other immediate measures that the government considered in order to address the short term supply gap were:

Interruptible Load Programme (ILP). Designed to entice greater participation from the different distribution utilities (DUs) with embedded generating capacities or those large users within their franchise having backup generating capacities to utilize such capacities. Under this programme, the DUs with approved ERC power rates will operate their embedded generating capacity, while the large users running their backup generator sets will be paid by the DU within the franchise area. The reduction of the power load requirements of the DUs with an embedded generator will be transferred to other DUs requiring additional supply.

Interim Mindanao Electricity Market (IMEM). The establishment of an electricity market in Mindanao is seen as a mechanism to provide for a central dispatch and price for available capacity. Transaction in the IMEM will only be undertaken during supply shortfall. Power generating companies with uncontracted capacity as well as DUs and large users with available embedded generating capacity may nominate/bid to the IMEM their available capacity for dispatch at an approved bid price.

Power generation

Gross electricity generation in 2016 went up by 10.2% from the previous year’s level of 82 413 GWh to 90 798 GWh.

Source: 2016 Philippine Power Statistics, Department of Energy http://www.doe.gov.ph

TABLE 3. INSTALLED CAPACITY, ELECTRICITY PRODUCTION, CONSUMPTION

| Compound Annual Growth Rate % |

|||||||

| Year | 1990 | 2000 | 2005 | 2010 | 2015 | 2016* | 2000–2016 |

| Capacity of electrical plants (GW(e)) | 6.87 | 13.18 | 15.62 | 16.36 | 18.76 | 21.42 | 14.09 |

| - Thermal | 3.14 | 4.99 | 3.66 | 3.19 | 3.61 | 3.61 | 0.0 |

| - Hydro | 2.15 | 2.30 | 3.22 | 3.40 | 3.60 | 3.62 | 1.75 |

| - Nuclear | 0 | 0 | 0 | 0 | 0 | 0 | 0.00 |

| - Renewables, wind, solar, biomass | 0.017 | 0 | 0.026 | 0.073 | 0.813 | 1.42 | 2.22 |

| - Geothermal | 0.89 | 1.93 | 1.98 | 1.97 | 1.92 | 1.92 | 0.00 |

| - Coal | 0.53 | 3.96 | 3.97 | 4.87 | 5.96 | 7.42 | 8.00 |

| -Natural Gas | 0 | 0.003 | 2.77 | 2.86 | 2.86 | 3.43 | 8.00 |

| - Total | 6.87 | 13.18 | 15.62 | 16.36 | 18.76 | 21.42 | 14.09 |

| Electricity production (TWh) | 25.90 | 45.29 | 56.57 | 67.74 | 82.41 | 90.80 | 26.94 |

| - Thermal | 12.43 | 9.18 | 6.14 | 7.10 | 5.89 | 5.66 | 0.00 |

| - Hydro | 6.06 | 7.80 | 8.39 | 7.80 | 8.67 | 8.11 | –7.06 |

| - Nuclear | 0 | 0 | 0 | 0 | 0 | 0 | 0.00 |

| - Renewables, wind, solar, biomass | 0.043 | 0 | 0.019 | 0.090 | 1.25 | 2.80 | 6.65 |

| - Geothermal | 5.47 | 11.63 | 9.90 | 9.93 | 11.04 | 11.07 | 0.00 |

| - Coal | 1.93 | 16.66 | 15.26 | 23.30 | 36.68 | 43.30 | 22.27 |

| - Natural Gas | 0 | 0.017 | 16.86 | 19.52 | 18.88 | 19.85 | 20.53 |

| Total electricity consumption (TWh) | 25.90 | 45.29 | 56.57 | 67.74 | 82.41 | 90.80 | 26.94 |

Notes: Electricity transmission losses are not deducted.

Generation data includes grid connected, embedded and off-grid generators.

IPP generation included in the utility.

Source: Power Statistics, Department of Energy.

TABLE 4. ENERGY RELATED RATIOS

| 1980 | 1990 | 2000 | 2010 | 2013 | 2014 | |

| Energy consumption per capita (GJ/capita) | 19.80 | 19.41 | 21.48 | 18.18 | 19.14 | — |

| Electricity consumption per capita (kWh/capita) | 373.50 | 360.74 | 499.73 | 644.27 | 692.66 | 706 |

| Electricity production/Energy production (%) | ||||||

| Nuclear/Total electricity (%) | 0 | 0 | 0 | 0 | 0 | 0 |

| Ratio of external dependency (%) ** |

—: no data available.

*Latest available data.

**Net import/Total energy consumption.

Source: data.worldbank.org/indicator

2. NUCLEAR POWER SITUATION

2.1. Historical Development and Current Organizational Structure

2.1.1. Overview

In 1958, the Philippine Atomic Energy Commission (PAEC) was established in accordance with Republic Act No. 2067, which was supported by then president Carlos P. Garcia.

In 1973, the Philippine economy was under a lot of pressure due to the oil crisis. With the intention of finding an alternative energy source, President Ferdinand Marcos decided in July of that year to construct a nuclear power plant (NPP). Workers started building the power plant in 1976. Construction was put on hold in 1979 because of the Three Mile Island accident that happened in the United States of America (USA). The president of the Philippines issued Executive Order No. 539, creating a Presidential Commission (Puno Commission) to conduct an inquiry into the safety of the Bataan Nuclear Power Plant. The BNPP was completed in 1984. Its construction cost the government US$2.3 billion. With its Westinghouse pressurized water reactor (PWR), the BNPP was supposed to generate 621 MW of electric energy.

In 1986, the Marcos regime ended and Corazon Aquino assumed the presidency. In April of that same year, the Chernobyl disaster happened. This was one of the major reasons Aquino did not push through with the full operation of the BNPP.

There were attempts to convert the NPP into a fossil fuel–based energy source, but such plans were deemed economically infeasible. In 2008, the International Atomic Energy Commission (IAEA) inspected the BNPP for possible rehabilitation.

The IAEA made the following recommendations: 1) the power plant’s status must be thoroughly evaluated by technical inspections and economic evaluations conducted by a group of experts with nuclear power experience in preservation and management, 2) the IAEA mission advised the government on the general requirements for starting its nuclear power programme, with emphasis on the proper infrastructure, knowledge and safety standards.

Representative Kimi S. Cojuangco filed House Bill No. 1291, “an act mandating an immediate validation process which satisfies internationally accepted nuclear power industry norms to determine the Bataan Nuclear Power Plant’s operability culminating in either the immediate rehabilitation, certification and commercial operation or the immediate permanent closure and salvage value recovery of the Bataan Nuclear Power Plant, appropriating funds therefore and for other purposes” at the fifteenth (15th) Congress and has not been acted upon until its closing hours.

The 16th Congress (2013–2016), has no bill filed to the lower house pertaining to the possible operation of the BNPP, but the upper house has Senate Bill 580, known as the “Bataan Nuclear Power Plant Operability Act”, filed by Senator Miriam Defensor-Santiago.

The plant is now open to the public and the country raises public awareness and provides educational information through technical briefing/audiovisual presentations and tours of the plant.

The last quarter of 2016 saw the renewed interest of the Philippine government under President Rodrigo R. Duterte in the inclusion of nuclear energy as part of the country’s energy mix.

It started with the Philippine hosting of the IAEA International Conference on the Prospects of Nuclear Power in the Asia Pacific Region spearheaded by the DOE from 29 August to 1 September 2016.

In October 2016, the DOE approved the creation of the Nuclear Energy Programme Implementing Organization (NEPIO).

To date, the department is carefully studying the country’s national position on nuclear energy in compliance with IAEA’s key area for nuclear infrastructure.

2.1.2. Current Organizational Chart(s)

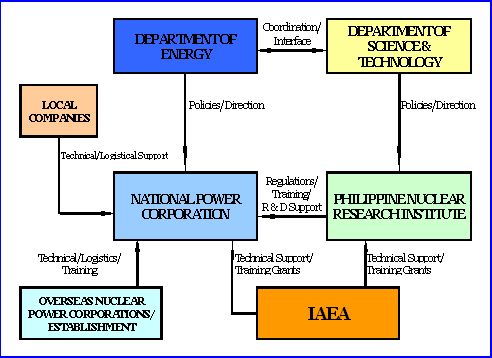

The Philippine Nuclear Research Institute (PNRI) is mandated to undertake research and development activities in the peaceful uses of nuclear energy, to institute regulations on said uses and to carry out the enforcement of said regulations to protect the health and safety of radiation workers and the general public.

The DOE is the executive department of the Philippine government responsible for preparing, integrating, coordinating, supervising and controlling all plans, programmes, projects and activities of the government relative to energy exploration, development, utilization, distribution and conservation.

The National Power Corporation (NPC or NAPOCOR) is a state-owned company that serves as the largest provider and generator of electricity in the Philippines.

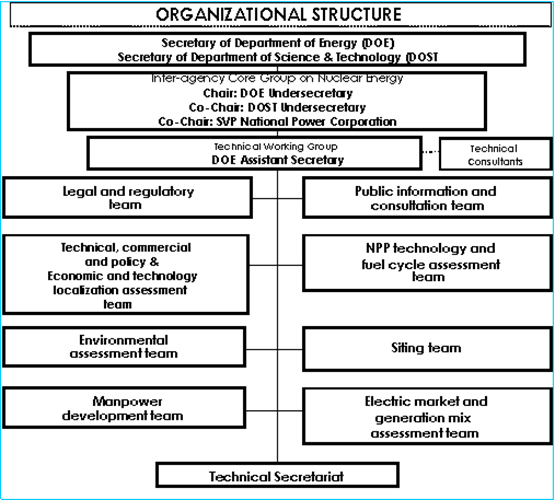

NPC started to set up the initial organization and studies for the nuclear project implementation (see Fig. 4).

Fig. 4. Nuclear organizational chart.Sources: www.pnri.dost.gov.ph/

2.2. Nuclear Power Plants: Overview

2.2.1. Status and Performance of Nuclear Power Plants

TABLE 5. STATUS AND PERFORMANCE OF NUCLEAR POWER PLANTS

| Reactor Unit | Type | Net Capacity [MW(e)] |

Status | Operator | Reactor Supplier |

Construction Date |

First Criticality Date |

First Grid Date |

Commercial Date |

Shutdown Date |

UCF for 2016 |

| BNPP-1 | PWR | 620 | Cancelled Constr. | RPNPC | WH | 1976-07-01 | 1986-05-01 |

| Data source: IAEA - Power Reactor Information System (PRIS). | |||||||||||

| Note: Table 7 is completely generated from PRIS data to reflect the latest available information and may be more up to date than the text of the report. |

Source: PRIS database (www.iaea.org/pris), BNPP, National Power Corporation.

2.2.2. Plant Upgrading, Plant Life Management and License Renewal

The BNPP is under preservation since its completion in 1986 and a preservation team from the NPC has been working to preserve the plant up to present.

Due to the need for a potentially cheap and safe power generation facility, the Philippine government is considering the rehabilitation of BNPP.

The Korea Electric Power Corporation (KEPCO) performed a feasibility study on BNPP from February to April 2009.

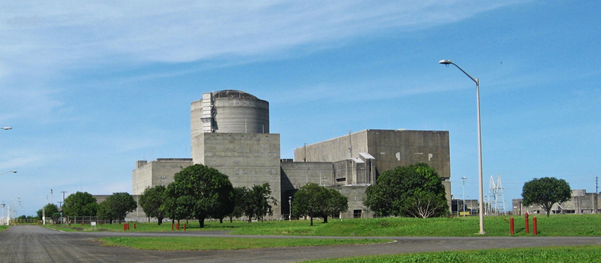

Fig. 5. Bataan Nuclear Power Plant.

2.2.3. Permanent Shutdown and Decommissioning Process

Not applicable.

2.3. Future Development of Nuclear Power Sector

Not applicable.

2.3.1. Nuclear Power Development Strategy

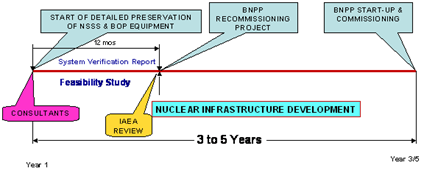

Since the creation of the DOE in 1992, only the PEP covering the planning period of 1998–2035 incorporated nuclear as a long term energy supply option. The 1998 plan forecast developed four scenarios to determine its sensitivity to different energy policy alternatives and the impact of regional cooperation programmes. Under the plan, a 600 MW nuclear plant is planned to be operational by 2025. Additional nuclear plant units, 600 MW each, were planned to be completed in 2027, 2030 and 2034. Thus, under the PEP 1998–2035, the total nuclear capacity was projected to reach 2 400 MW by the end of the planning period. At present, a bill for the recommissioning of the BNPP is pending in the Philippine Congress, which when passed into law would hasten the nuclear programme for the Philippines. Likewise, operation of the said power plant would also trigger the construction of more units. When the BNPP recommissioning bill is approved, feasibility for the plant’s recommissioning will be undertaken and within a period of three to five years, BNPP may be put into operation (Fig. 6).

Fig. 6. Nuclear infrastructure development.

The contract for the recommissioning of BNPP may be through a government to-government arrangement. For the nuclear power cycle involving the BNPP, the recommendations from which the Philippine government would contract its recommissioning project would be the prime consideration. However, for the future programmes, the Philippine strategy for the back end of the cycle at the moment would be for long term storage of spent fuel on-site, while waiting for the identification of the Philippines National Radwaste Repository Centre. A suitable site within the Philippines was already identified for this centre.

TABLE 6. PLANNED NUCLEAR POWER PLANTS

| Station/Project/Name | Type | Capacity | Expected Construction Start Year |

Expected Commercial Year |

| BNPP | PWR | 620 MW | 1976 | Decommissioned |

| NPP 1 | PWR | 600 MW | 2015 | 2025 |

| NPP 2 | New Generation NPP | 600 MW | 2017 | 2027 |

| NPP 3 | New Generation NPP | 600 MW | 2020 | 2030 |

| NPP 4 | New Generation NPP | 600 MW | 2025 | 2035 |

Source: Philippine Energy Plan.

Fig. 7. Organizational structure.

The development of the country’s nuclear power programme is vested under a governmental ad-hoc committee described in Figure 7. By virtue of an inter-departmental order between DOE and the Department of Science and Technology (DOST), an inter-agency core group on nuclear energy was created. Its primary objective is the development, management and setting up of policies and strategies which will involve nuclear power generation. Part of their mandate is the feasibility study for the possible recommissioning of BNPP.

2.3.2. Project Management

In April 1986, the Philippine government decided to mothball BNPP. In May 1986, the contract with Westinghouse was suspended and the plant was placed under preservation.

Rene A.V. Saguisag, chairman of the Bataan Nuclear Power Plant Committee (which was formed by the Philippine government under President Corazon Aquino to look into the fate of the plant), officially informed the NPC in July 1986 that the government would not operate the BNPP.

The oversight of the BNPP was then transferred to the Philippine Government under Executive Order Nos 55 and 98, including its equipment, materials, facilities, records and uranium fuel, providing for the assumption of the remaining foreign loan obligations of the NPC with foreign lenders under the loans contracted by the NPC (guaranteed by the Republic of the Philippines and of the peso obligations incurred to finance the construction of BNPP by the Government) and for other purposes in November 1986. The plant’s short term preservation thus started.

In August 1992, the nuclear power plant preservation project was formed under the Special Projects Group. From April 2003 up to the present, the plant was under the Asset Preservation Department under Mauro L. Marcelo, Jr.

2.3.3. Project Funding

The nuclear power project would be funded by an external financing organization in view of the huge capital cost necessary in putting up a new plant. Likewise, in case of the BNPP recommissioning, external funding may also be required. However, the recommissioning bill has made certain provisions in the electricity tariff as source of funds for BNPP.

2.3.4. Electric Grid Development

New high voltage transmission lines as well as a switchyard upgrade will be necessary for the recommissioning of BNPP, as well as for potential new power plants.

2.3.5. Sites

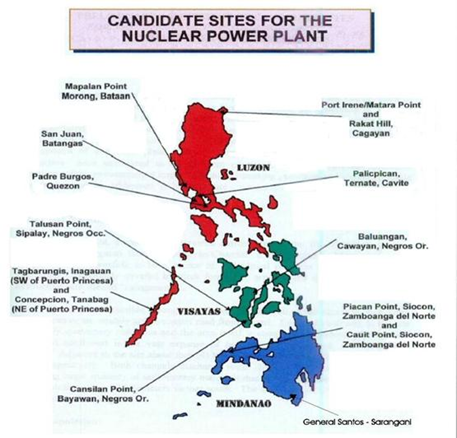

In 1998, the government created a committee, the Nuclear Power Steering Committee, to provide the direction of the country’s nuclear power programme during this period. It identified numerous possible sites throughout the country as future sites for NPPs, as shown in Figure 8.

Fig. 8. Other candidate sites for a nuclear power plant.

The Bataan site would only need a date update for its environmental impact assessment. All other sites that were explored are located near the sea, with abundant cooling water obtainable from the sea. Likewise, all identified sites are accessible by land transportation and within range of transmission lines.

2.3.6. Public Awareness

The DOE, together with the NPC and the PNRI are engaging in an information and education campaign (IEC) on power technology options, including the exploration of nuclear power.

Among its objectives are:

To consult the people living in the neighbouring area of the BNPP of their power plant preference and to complete profiling of such.

To inform and educate the people living in the neighbouring area of the BNPP on power plant technologies other than the nuclear power plant.

2.4. Organizations Involved in Construction of NPPs

The NPC will be the main player based on existing laws and because of its vast experience in electrical power generation and construction. It has its own engineering, technical services and project management organizations which are well equipped to handle the pre-construction activities, construction stage, operation and maintenance and decommissioning of an NPP.

2.5. Organizations Involved in Operation of NPPs

The NPC will be responsible for the operation of NPPs.

2.6. Organizations Involved in Decommissioning of NPPs

For the decommissioning of NPPs, the NPC will implement the activity.

2.7. Fuel Cycle, Including Waste Management

For the country’s first operational NPP, the front end of the nuclear fuel cycle will be sourced through foreign expertise, similar to the developed BNPP. The BNPP’s fuel supply contract with Westinghouse included mining and milling, uranium conversion and enrichment, up to fuel fabrication. The same scheme would be arranged for future plants and BNPP, should it be put into operation.

The new technology for on-site interim storage of spent fuel would be used until a firm governmental decision is issued with regards to the future use of the spent fuel. For BNPP, if put into operation, the storage facility will be set up.

Reprocessing is at present not among the priorities for the nuclear programme, however, should there be a decision on the reprocessing of spent fuel for conversion into fuel again, then it will be sent to a country where the industry is already in place or already matured.

On the issue of waste management, the PNRI, through the technical and financial assistance of the IAEA, has already identified suitable sites within the Philippines as its National Radwaste Repository Centre. The centre is being set up for the long term storage of high level waste coming from hospitals, from the PNRI itself and from NPPs in the future.

2.8. Research and Development

2.8.1. R&D Organizations

At present, the PNRI has the mandate on R&D in the field of nuclear sciences and technology. Yet, the country does not have any private institution that deals in this field. However, the pending bill in Congress on the reactivation of BNPP has included provisions for nuclear R&D. Also, upon embarking on nuclear power, the country’s science and technology industry will certainly add R&D on peaceful nuclear uses.

2.8.2. Development of Advanced Nuclear Technologies

The country is not engaged in any advanced nuclear technology development.

2.8.3. International Cooperation and Initiatives

On the international level, the PNRI acts as the national government agency which represents the country as a Member State in the IAEA. PNRI has cooperative agreements in nuclear technology with 16 other member states of the Regional Cooperative Agreement (RCA) for research, development and training related to nuclear sciences and technology for Asia and the Pacific. The PNRI partners with several organizations and entities like the RCA regional office (RCARO), Forum for Nuclear Cooperation in Asia (FNCA), Comprehensive Nuclear-Test-Ban Treaty Organization (CTBTO) and other organizations from Australia, Canada, Japan, Republic of Korea, the United States of America and other countries through bilateral and/or institute-to-institute agreements.

2.9. Human Resources Development

The present government emphasizes human resource capability building and enhancement as a necessary prelude to considering nuclear power as a long term energy option. Capability building and enhancement on the various aspects of nuclear energy will involve training local personnel for the possible introduction of nuclear power into the country’s energy system.

Currently, the DOE, as the focal governmental institution on the nuclear power programme, is leading an inter-agency discussion among the concerned governmental organizations, the academy and the private sector to flesh out the responsibilities of rebuilding local technical capability in nuclear sciences and engineering. Due to the retirement of many engineers, additional human resources will need to be recruited and developed.

2.10. Stakeholder Involvement

A communication programme titled BNPP Communication Plan, to be implemented by the NPC’s corporate communications, is on the drawing board with the following objectives:

Raising the level of awareness among the concerned public of the benefits of nuclear power in general and revival of the BNPP in particular;

Addressing the issues being raised by anti-nuclear and anti-BNPP parties through various forms;

Creating a positive environment for the acceptance of the revival of the BNPP, as a possible option in addressing the lack of generation capacity.

The target audiences for the plan are the general public, media, decision makers and stakeholders, such as the Philippine Congress, local government units (LGUs), churches, local media, non-governmental organizations and the private sector.

Communication approaches will be through the tri-media (TV, print and radio) approach of press releases, feature stories and interviews, and guest/personal appearances to relevant talk shows. The other approach is inter-personal, like hosting public fora and symposia with students from major academic institutions and LGUs within the vicinity of the BNPP, and including sponsorship tours to the plant site. The media to be used will be the major broadsheets and magazines, leaflets, posters and flyers, comic books and five-minute feature stories and visual productions on TV.

2.11. Emergency Preparedness

The BNPP plan addresses general organizational responsibilities, capabilities, actions and guidelines for the NPC in the event of a radiological emergency at the site.

The prime objective in radiological emergency planning is to develop a plan and implement procedures that will ensure emergency preparedness and provide a means for mitigating the consequences of emergencies, including very low probability events, in order to prevent damage to property and to protect the health and safety of the general public and site personnel.

The BNPP Radiological Emergency Plan (BNPP-REP) will ensure the following:

Adequate measures taken to protect employees and the public;

All individuals have responsibilities during accidents and are properly trained;

Procedures exist to provide the capability to cope with a spectrum of accidents ranging from those of little consequence to major core melt;

Equipment is available to detect, assess and mitigate the consequences of such occurrences;

Emergency action levels and procedures are established to assist in making decisions.

3. NATIONAL LAWS AND REGULATIONS

3.1. Regulatory Framework

3.1.1. Regulatory Authority(ies)

The present nuclear regulatory authority is the PNRI, formerly the PAEC. The PNRI’s basis for nuclear power plant regulation is the United States Nuclear Regulatory Commission (USNRC) Code of Federal Regulations.

3.1.2. Licensing Process

The licensing procedures involve three main processes: 1) the provisional permit stage where a licensee is issued with a provisional permit or limited work authority; 2) the construction permit stage where a construction permit is issued upon a licensee’s satisfying or complying with various requirements of the Preliminary Safety Analysis Report; 3) the operating license stage, where after completion of all conditions present, regulatory requirements, licensing of operators, etc., an operating license is issued, whereby the licensee can then proceed with fuel core loading and initiate reactor operation for criticality.

3.2. National Laws and Regulations in Nuclear Power

Republic Act No. 2067 (Science Act of 1958) created PAEC. At the initiative of PAEC, the Philippine Congress enacted Republic Act No. 3859, amending RA 2067, to provide PAEC with a dual mandate to promote the peaceful applications of atomic energy and to license and regulate the use of radioactive materials.

Republic Act No. 5207 (Atomic Energy Regulatory and Liability Act of 1968) was enacted by Congress to establish the comprehensive nuclear regulatory function of PAEC. It provided authority to PAEC to issue licenses for the construction, possession and operation of any atomic energy facility. It also served as the basis for the promulgation of rules and procedures in the licensing of nuclear power plants.

RA No. 6395, enacted in 1971, authorized the NPC to established and operate NPPs.

Presidential Decree No. 606 issued on 13 December 1974 constituted PAEC as an independent and autonomous body, transferring the same from the National Science Development Board (NSDB) to the Office of the President.

With the creation of the Ministry of Energy (MOE) under Presidential Decree No. 1206, dated 6 October 1977, PAEC was transferred to the control and supervision of the MOE from the Office of the President.

Executive Order No. 613, dated 15 August 1980 transferred PAEC from MOE back to the Office of the President.

Code of PAEC Regulations (CPR) promulgated in April 1981 under Administrative Order No. 1 Series of 1981. The National Standards/Regulatory Requirements were as follows:

CPR Part 3, “Standards for Protection Against Radiation”;

CPR Part 4, “Rules and Regulations on the Safe Transport of Radioactive Material”;

CPR Part 7, “Licensing of Atomic Energy Facilities”, based mainly on USNRC documents and IAEA Standards, codes and guidelines.

Executive Order No. 708, which was promulgated on 27 July 1981, attached PAEC to the Office of the Prime Minister.

On 17 March 1984, Executive Order No. 784 reorganized NSDB to National Science and Technology Authority (NSTA) and placed PAEC under its administrative supervision. Executive Order No. 980, dated 29 August 1984, converted PAEC from a single-headed agency into a multi-headed agency composed of a chairman and four (4) associate commissioners forming the Board of Commissioners. It reaffirmed PAEC’s role as the nuclear regulatory board.

Executive Order No. 128, dated 30 January 1987, reorganized NSTA to DOST and PAEC to the PNRI, headed by a director and assisted by a deputy director.

House Bill No. 6300, “An Act Mandating the Immediate Rehabilitation, Commissioning and Commercial Operation of the Bataan Nuclear Power Plant, Appropriating Funds therefore, and for Other Purposes” (2009).

House Bill Nos 3155 and 3254, “An Act to Regulate the Nuclear, Security and Safety Aspects in the Peaceful Utilization of Radiation Sources through the Creation of the Philippine Nuclear Regulatory Commission Appropriating Funds Therefore, and for Other Purposes” (2009)

House Bill No. 1291, “An Act Mandating an Immediate Validation Process Which satisfies Internationally Accepted Nuclear Power Industry Norms to Determine the Bataan Nuclear Power Plant’s Operability Culminating in Either the Immediate Rehabilitation, Certification and Commercial Operation or, the Immediate Permanent Closure and Salvage Value Recovery, of the Bataan Nuclear Power Plant, Appropriating Funds Therefore, and for Other Purposes” (July, 2010).

REFERENCES:

Philippine Energy Plan 2007–2014, “Fuelling Philippine Development through Greater Access to Energy”, DOE.

Highlights of the 2009–2030 Philippine Energy Plan, DOE.

PNRI @ 50, “Making Science and Technology Work for You”, PNRI, 2008.

PNRI Nuclear Research Institute Annual Report, 2007.

Philippine Nuclear Power Plant Unit 1, General Information and Technical Features, National Power Corporation, Engineering Division, February 1984.

APPENDIX 1: INTERNATIONAL, MULTILATERAL AND BILATERAL AGREEMENTS

International Treaties, Conventions and Agreements Signed/Ratified:

The Convention on Nuclear Safety;

The Joint Convention on Safety of Spent Fuel Management and on the Safety of Radioactive Waste Management;

The Joint Protocol Relating to the Application of the Vienna and Paris Convention;

The Protocol to Amend the Vienna Convention on Civil Liability for Nuclear Damage;

Convention on Supplementary Compensation for Nuclear Damage;

The Protocol Additional to the NPT Safeguards Agreement;

A Party to the Southeast Asia Nuclear Weapons Free Zone Treaty.

Cooperation Agreements with the IAEA in the Area of Nuclear Power

Human Resources Development and Nuclear Technology Support, 2003–2008;

Development of a Near-Surface Radioactive Waste Disposal Facility, 2007–2008 Bilateral Agreements with other Countries or Organizations Signed/Ratified by the Country in the Field of Nuclear Power;

Memorandum of Understanding for Cooperation on the Nuclear Power Project in the Philippines between NPC and KEPCO.